st louis county personal property tax calculator

Louis County collects on average 125 of a propertys. Monday - Friday 800am - 500pm.

Property Tax Webster Groves Mo Official Website

City Hall Room 109.

. November 15th - 2nd Half Agricultural Property Taxes are due. 41 South Central Avenue Clayton MO 63105. Commercial real property however.

Louis County Missouri is 2238 per year for a home worth the median value of 179300. Louis County real estate tax. To declare your personal property declare online by April 1st or download the printable forms.

Account Number number 700280. May 16th - 1st Half Agricultural Property Taxes are due. November through December 31st you may also drop off.

Louis Property Tax Inquiry Options. November 15th - 2nd Half Manufactured Home Taxes are due. Learn all about St.

Louis County Personal Property Tax Lookup. Property tax rates are amounts per 100 of assessed value on a piece of property. Whether you are already a resident or just considering moving to St.

Account Number or Address. Louis County to live or invest in real estate estimate local property. The median property tax in St.

Please contact the State Auditors Tax Rate Section if you have any questions regarding the calculation of property taxes at 573-751-4213. The states average effective property tax rate is 093 somewhat lower than the national average of 107. Rates in Missouri vary significantly depending on where you live though.

See all other payment options below for associated fees. The following calculators can assist you with. Payments can be made by clicking on the Pay your taxes button or by calling.

This rate applies to personal property as well as real property. Monday - Friday 8 AM - 5 PM. Louis County Government Portal.

An original or copy paid personal property tax receipt or a statement of non-assessment from your county of residence or city of St. Pay by E-Check for FREE online with Paymentus. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local.

Personal Property Tax Department. Charles County pays 2624 annually in. Louis County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax.

If your taxes are delinquent you will need to contact the County Auditor at 218-726-2383 to obtain the. Louis County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax. All Personal Property Tax payments are due by December 31st of each year.

Los Angeles Rams Move Negatively Affects Players Financially Sports Illustrated

This Is The City With The Lowest Property Taxes In America Marketwatch

Mortgage Calculator Monthly House Payment

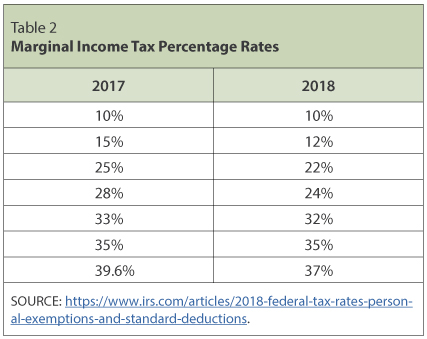

Individual Income Tax The Basics And New Changes St Louis Fed

Missouri 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Assessor Of Oklahoma County Government

Missouri Car Sales Tax Calculator

Calculating Estimated Property Taxes St Charles County Mo Official Website

Clay County Missouri Tax A Resource Provided By The Collector And Assessor Of Clay County Missouri

Racial Inequality Broken Property Tax System Blocks Black Wealth Building Bloomberg

Las Vegas Sales Tax Rate And Calculator 2021 Wise

Tax Rates Creve Coeur Mo Official Website

Opinion How Lower Income Americans Get Cheated On Property Taxes The New York Times

City Versus County Tax Sales Your St Louis Missouri Guide Tdd Attorneys At Law Llc

Missouri Property Tax H R Block

County Assessor St Louis County Website

Property Tax How To Calculate Local Considerations